BlackRock CEO Larry Fink Blames Nationalism And Immigration Restrictions For InflationChris MenahanInformationLiberation Jun. 14, 2022 |

Popular

As Poll Finds Ukrainians Want to End War, U.S. Pushes Zelensky to Bomb Russia and Expand Conscription

FBI Pays Visit to Pro-Palestine Journalist Alison Weir's Home

Schumer Moves to Silence Criticism of Israel as Hate Speech With 'Antisemitism Awareness Act'

Federal Judge Orders Hearing Into Questionable 'Auction' of Infowars to The Onion

'More Winning!' Ben Shapiro Celebrates Trump Assembling an Israel First Cabinet

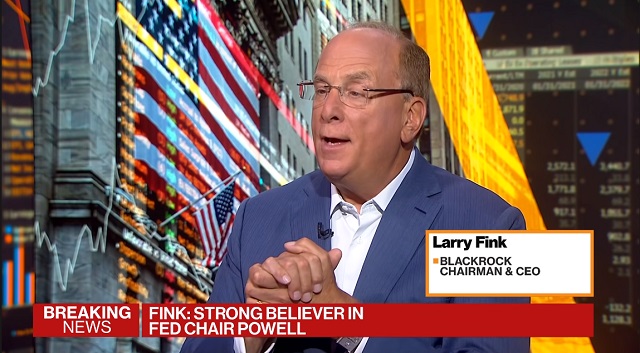

The rise of nationalism and immigration restrictions are to blame for inflation, not the Federal Reserve printing trillions of dollars, according to BlackRock CEO Larry Fink. The rise of nationalism and immigration restrictions are to blame for inflation, not the Federal Reserve printing trillions of dollars, according to BlackRock CEO Larry Fink.Fink, who manages some $10 trillion in assets, told Bloomberg earlier this month that he believes inflation is "not Fed related." [Embed starts at 5:50] "I would say, 10 years ago, the rise-- whether you call it nationalism or the rise of this belief that we have to focus on communities that have been devastated by globalization, we need to find ways of creating better jobs for more Americans, that in itself is inflationary," Fink said. "When you move away from the cheapest price ever to another area and so that's a fundamental change," he continued. "We change your immigration policies and I'm talking about legal immigration okay our legal immigration, that was changed about five years ago where we've reduced the amount of legal immigration." "If you look at the rate of increase of immigrants, legal immigrants in the United States from 2000 to 2017 and the rate that we are growing immigration in the last five years we're down 2 million, 2 million new entrants to the United States legally. That is very inflationary when we have full employment when we have these jobs think about all the need for workers," Fink said. BlackRock has been contributing to inflation by driving up home prices though buying up single family homes and turning them into rentals. Fink has also been at the forefront of the "Woke Capital" movement by using the trillions he manages as a cudgel to force public companies to advance globo-homo policies. Federal Reserve Chair Jerome H. Powell and Treasury Secretary Steven Mnuchin partnered with Fink during the covid economic meltdown to "rescue" key businesses with political clout. As markets were falling, "America's top economic officials were in near-constant contact with a Wall Street executive whose firm stood to benefit financially from the rescue," the New York Times reported last year. From the NYT: Laurence D. Fink, the chief executive of BlackRock, the world’s largest asset manager, was in frequent touch with Mr. Mnuchin and Mr. Powell in the days before and after many of the Fed’s emergency rescue programs were announced in late March. Emails obtained by The New York Times through a records request, along with public releases, underscore the extent to which Mr. Fink planned alongside the government for parts of a financial rescue that his firm referred to in one message as “the project” that he and the Fed were “working on together.”It sure must be nice to be the biggest asset manager in the world and have a direct partnership with the Fed. It's no surprise Fink is defending this corrupt system -- he's in charge of it. Follow InformationLiberation on Twitter, Facebook, Gab, Minds and Telegram. |